04/16/24 - Jerome

Cryptocurrency mining is the process of validating transactions on a blockchain network and adding them to a distributed ledger. This pivotal role secures the network against double-spending by updating the digital ledger with verified transactions. As miners receive new coins as rewards, they are incentivized to deploy powerful machines to solve complex mathematical equations—a challenge that escalates as more advanced mining hardware becomes available. With the evolution from simple CPU chips to specialized GPU or ASIC miners, determining the best crypto miner involves considering factors like hashrate, power consumption, and overall efficiency.

As you embark on the journey of cryptocurrency mining, understanding the dynamics of crypto mining pools and the significance of joining one to increase your chances of earning rewards is crucial. The landscape of cryptocurrency mining has matured, necessitating a strategic approach to selecting the best crypto mining rig. This rig should ensure not only profitability but also sustainability in terms of energy consumption. This article will guide you through the essential factors to consider when choosing a cryptocurrency for mining, from profitability factors like Bitcoin and Kaspa to key considerations such as SHA-256 compatibility, mining hardware specifications, and the legal and tax implications of mining activities.

Key Factors in Choosing a Cryptocurrency for Mining

When diving into the world of cryptocurrency mining, several critical factors influence your decision on which currency to mine. These factors impact the profitability, feasibility, and sustainability of your mining venture:

Profitability Factors:

●Block Time and Reward: The frequency at which blocks are mined and the reward for each block. Shorter block times can lead to more frequent rewards.

●Price per Coin: A higher market value can increase profitability, making high-market-cap coins potentially more lucrative.

●Difficulty and Hash Rate: Higher difficulty and hash rate mean more competition and higher energy consumption, but potentially higher rewards.

●Power Consumption and Hardware Cost: Efficient hardware with lower energy consumption enhances profitability. Assess both the initial cost and ongoing expenses.

Mining Environment:

●Development Team and Community Support: A strong, active community and a clear future roadmap can indicate a coin’s long-term viability.

●Regulatory Environment: Awareness of legal and tax implications is crucial, as these can affect profitability.

●Mining Hardware Requirements: Ensure compatibility and assess the cost and availability of necessary hardware.

Market Dynamics:

●Market Demand and Volatility: Consider current and future demand and market stability. High volatility can affect both the coin's value and mining profitability.

●Mining Pool Availability: Joining a reliable mining pool can increase the chances of earning rewards.

●Energy Costs: Opt for cryptocurrencies that align with your area's energy costs to maintain profitability.

Understanding these factors will guide you in selecting the most suitable cryptocurrency for mining, balancing profitability with practicality and future growth prospects.

Top Cryptocurrencies for Mining with ASICs in 2024

Bitcoin (BTC): The Most Popular Crypto to Mine

Bitcoin, with its status as the original cryptocurrency, remains at the forefront of the crypto mining scene in 2024, holding its position as the most popular and profitable cryptocurrency to mine. The allure of Bitcoin mining lies not just in the potential financial rewards but also in the integral role miners play in validating transactions and securing the network.

Complexity and Reward: The mining process involves solving cryptographic puzzles that validate transactions and secure the blockchain, with successful miners receiving Bitcoin as a reward. This reward, however, is halved approximately every four years, reducing from an initial 50 bitcoins per block to the current rate of 6.25 BTC, making the endeavor increasingly competitive.

Environmental Considerations: Despite its profitability, Bitcoin mining has sparked debates over its environmental impact. According to the latest data, as of March 25, 2024, Bitcoin's daily power demand was estimated at about 20.08 gigawatt hours (GWh), which translates to an annualized estimate of approximately 176.02 terawatt hours (TWh) of electricity consumption—a figure surpassing the energy consumption of many countries.

Mining Hardware: To mine Bitcoin effectively, one needs sophisticated ASIC gear, such as the Antminer S21 Hyd. This equipment is among the most potent mining hardware on the market, crafted to solve Bitcoin’s intricate computational challenges.

Mining Hardware: To mine Bitcoin effectively, one needs sophisticated ASIC gear, such as the Antminer S21 Hyd. This equipment is among the most potent mining hardware on the market, crafted to solve Bitcoin’s intricate computational challenges.

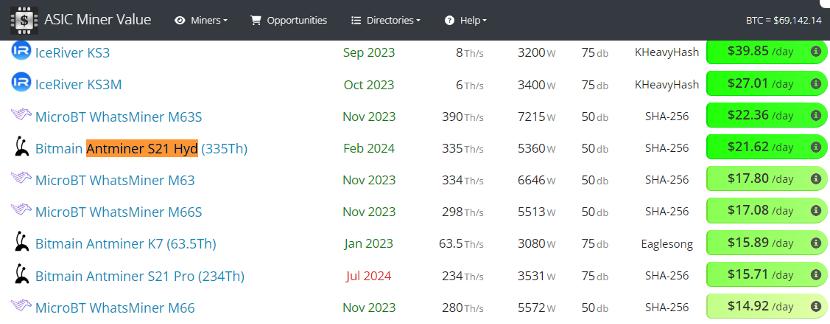

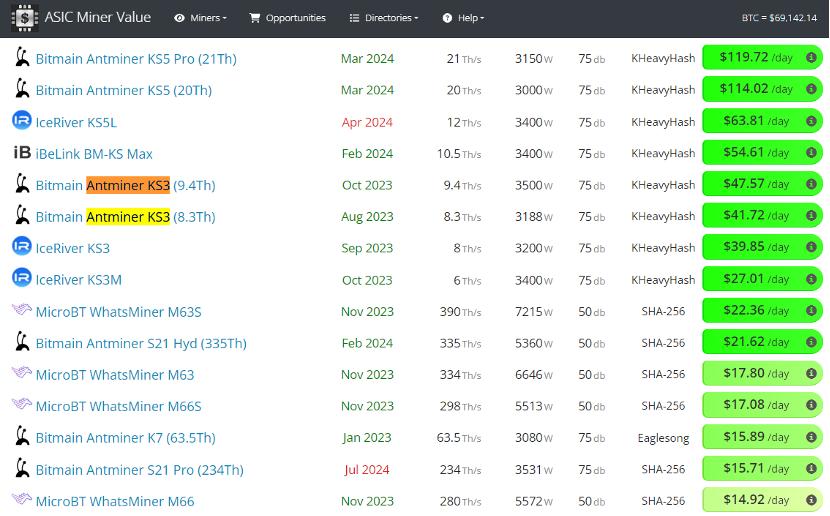

However, the profitability of mining is not guaranteed and depends on various factors. For instance, with the Antminer S21 Hyd, miners could see daily earnings of approximately $21.62. But, there's an average daily cost for electricity of $21.74, based on the electricity price of $0.169 per kWh in the U.S. Electricity expenses can greatly differ based on your location, significantly affecting your profits. Thus, the net daily earnings average out to about $21.62, as per ASIC Miner Value data. Annually, using a single Antminer S21 Hyd miner could bring in profits of around $7891.3.

Kaspa (KAS): One of the Most Profitable Cryptocurrencies to Mine

Mining Kaspa (KAS), currently popular on ASIC Miner Value, offers a lucrative opportunity for those utilizing ASIC miners to enhance their mining profitability. Take the Antminer KS3, a top ASIC for Kaspa mining, for example. Miners can anticipate making around $41.72 in daily revenue. In a similar vein, the IceRiver KAS KS3 generates a daily net profit of $39.85, and the IceRiver KAS KS3M produces a profit of $27 daily. Moreover, the projected annual profit for using an Antminer KS3 could potentially reach as high as $14,545, though this estimate may vary widely.

Therefore, it's important to approach these variables with caution. Be prepared for possible shifts in the market, changes in regulations, and the constant possibility of increased mining difficulty, any of which could affect the sustainability of mining Kaspa in the long term.

Key Considerations Before Selecting the Crypto to Mine

Before diving into the world of cryptocurrency mining, it's imperative to weigh several critical considerations to ensure both profitability and compliance:

Hardware and Energy Efficiency:

●Hash Rate: The speed at which a mining rig can solve the cryptographic puzzles. A higher hash rate increases chances of mining a block.

●Power Consumption: Evaluate the electricity usage of your mining setup. High power consumption can significantly reduce profitability.

●Overall Costs: Include the initial investment in mining hardware and ongoing expenses like electricity bills.

Mining Pool Selection:

Choosing the right mining pool requires careful consideration of various factors. It's important to assess the pool's size, as larger pools might offer more regular payouts due to their higher computational power, although the rewards may be smaller compared to what you could potentially earn in a smaller pool. Different pools have different methods for distributing earnings among their members, so understanding these can help you predict your mining rewards more accurately.

Fees are also a key consideration. Most pools charge a fee for the services they provide, which can vary significantly and directly impact your profitability. Additionally, the transparency of operations, including how well the pool communicates about its hash rate, security measures, and payout failures, is crucial for trust and reliability.

Joining a mining pool can significantly increase your chances of earning mining rewards by pooling computational resources. This collective approach to mining ensures more consistent earnings than solo mining, although it also means sharing rewards.

Conclusion

Through this exploration of the multifaceted world of cryptocurrency mining, we've delved into key considerations ranging from hardware requirements and mining profitability to the legal and environmental implications of such activities. This comprehensive dive not only highlights the dynamic and evolving nature of crypto mining but also underscores the critical importance of informed decision-making when selecting cryptocurrencies and mining hardware. By understanding these parameters, miners can optimize their strategies, ensuring profitability while mitigating potential risks and challenges.

As we look to the future, the landscape of cryptocurrency mining continues to evolve, driven by technological advancements, market fluctuations, and the emerging discourse around sustainability. For enthusiasts and prospective miners, staying abreast of these changes and adapting strategies accordingly will be paramount. While the journey to mining success is complex, armed with the insights provided, individuals are better positioned to navigate the intricacies of the crypto mining ecosystem, making calculated choices that align with their objectives and the broader trends shaping the digital currency domain.

Post time: Apr-16-2024